MENU TIGER: Easy Adding of Tax Rates to Menu Prices

Last Updated: August 12, 2025

MENU TIGER’s taxation feature improves the quality of your services by providing transparent tax inclusions in your customer’s receipts.

This helps avoid unpleasant surprises when their bill comes at the end of their meal. Doing so promotes transparency, and you can gain your consumers’ trust and respect.

Read more to learn the details of this integration and how to access it on the MENU TIGER interface.

How to include tax in prices using MENU TIGER

MENU TIGER is among the leading restaurant software programs that lets you easily create and customize a digital QR code menu for your restaurant, bar, or cafe.

Additionally, this digital platform offers various features, such as real-time updates, menu analytics, multilingual support, integration with well-known POS systems for streamlined services, and menu taxation.

To learn how to make sure all prices include tax on your menu, check out this guide: 1. Create your contactless digital menu account.

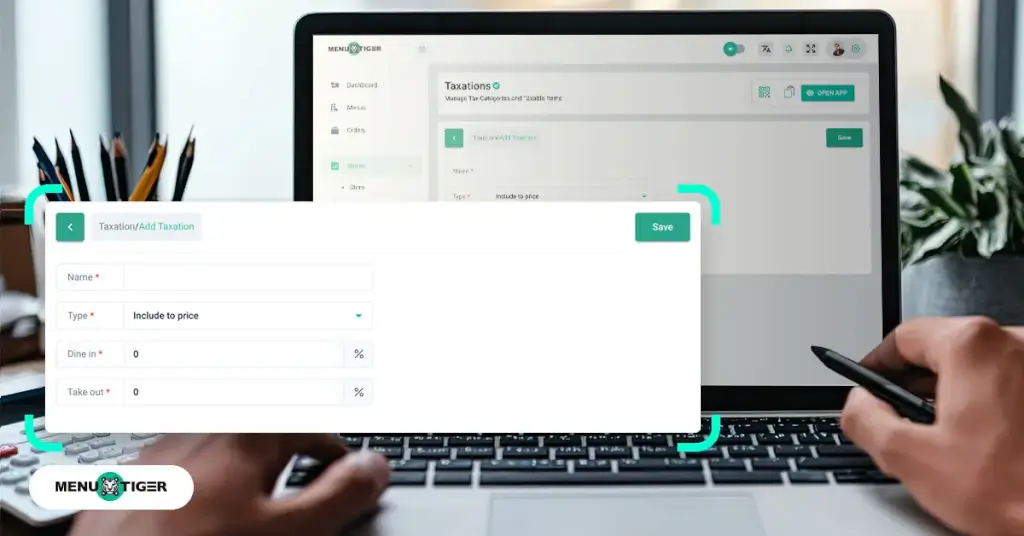

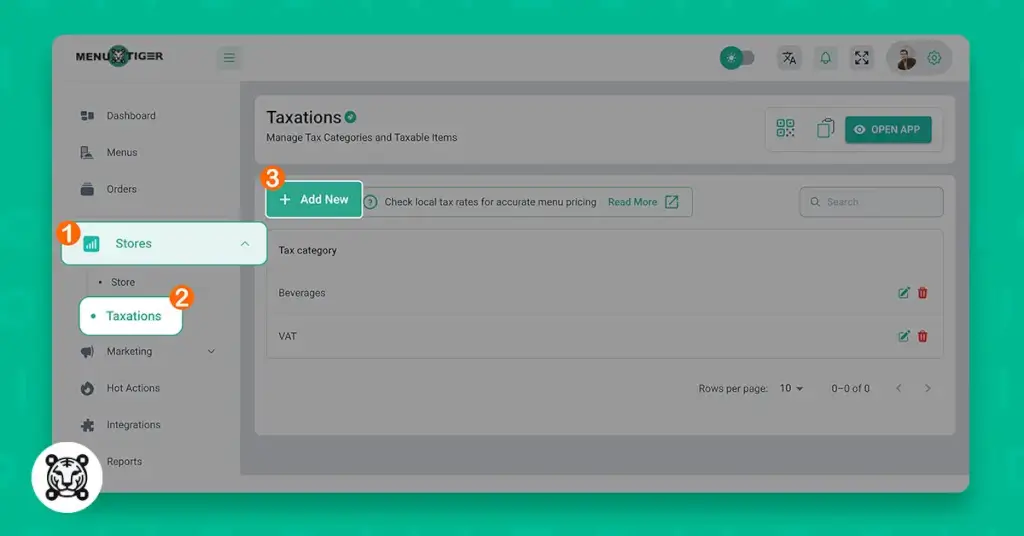

2. On your account’s dashboard, head over to the lefthand-side panel and click Stores. A dropdown option will pop up. Tap the Taxations button. Click + Add New.

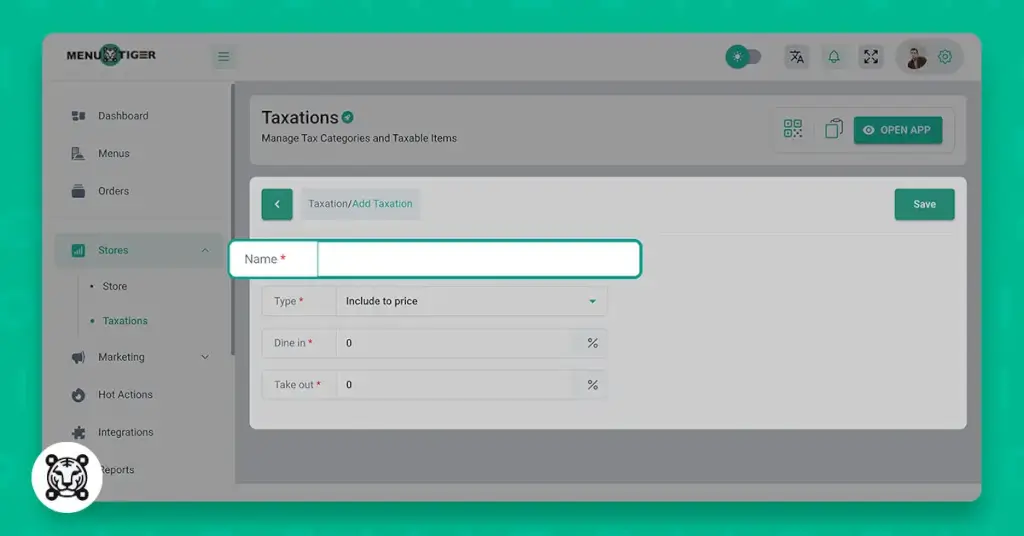

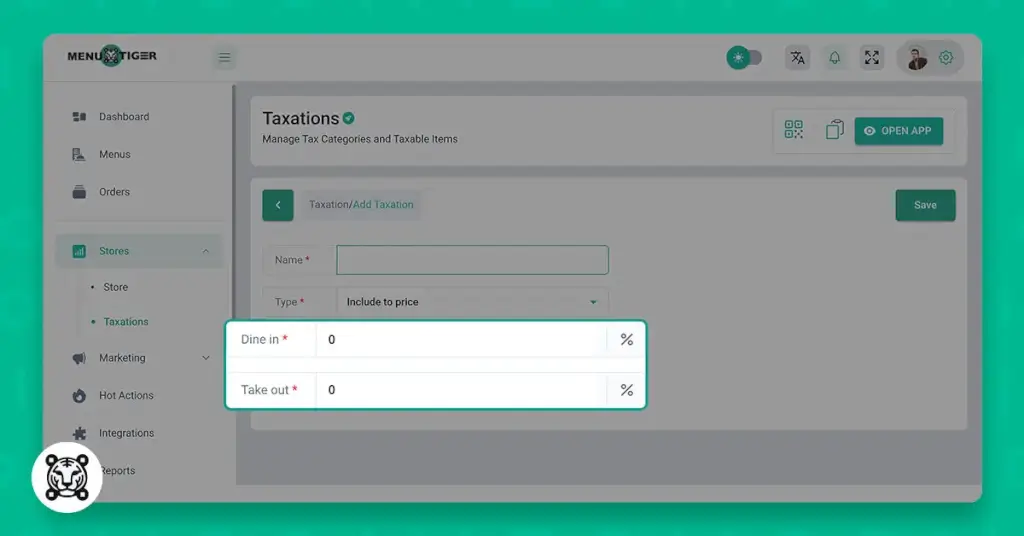

3. Provide your taxation category name.

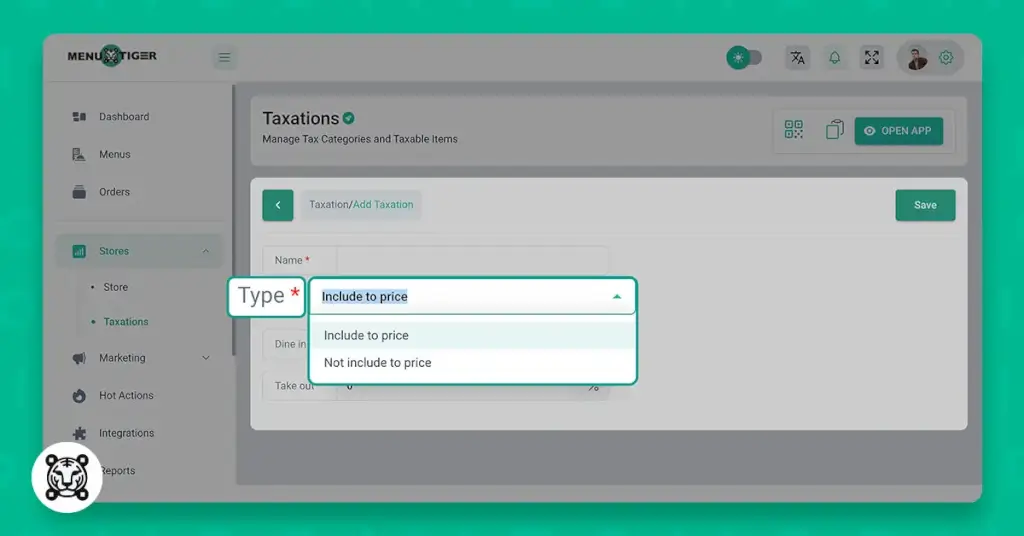

4. Choose the tax type. You can opt for Include to price (where all prices include tax) or Not include to price.

Take note: You can also choose Not include to price as your taxation type. Depending on your preferences and how you want customers to see your prices in your QR code menu.

5. Provide Tax rates percentage for Dine-in and Take-out.

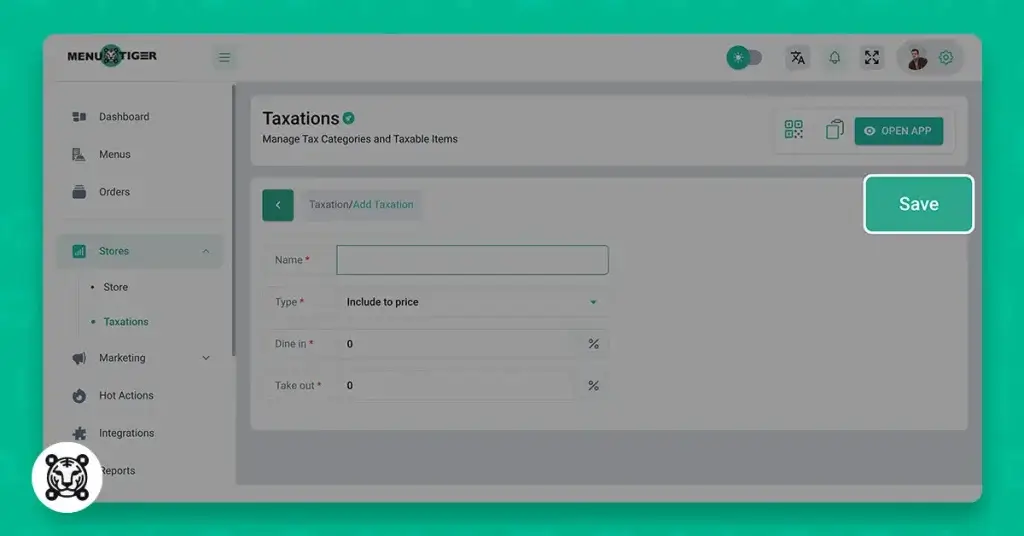

6. Click Save to successfully setup the taxation.

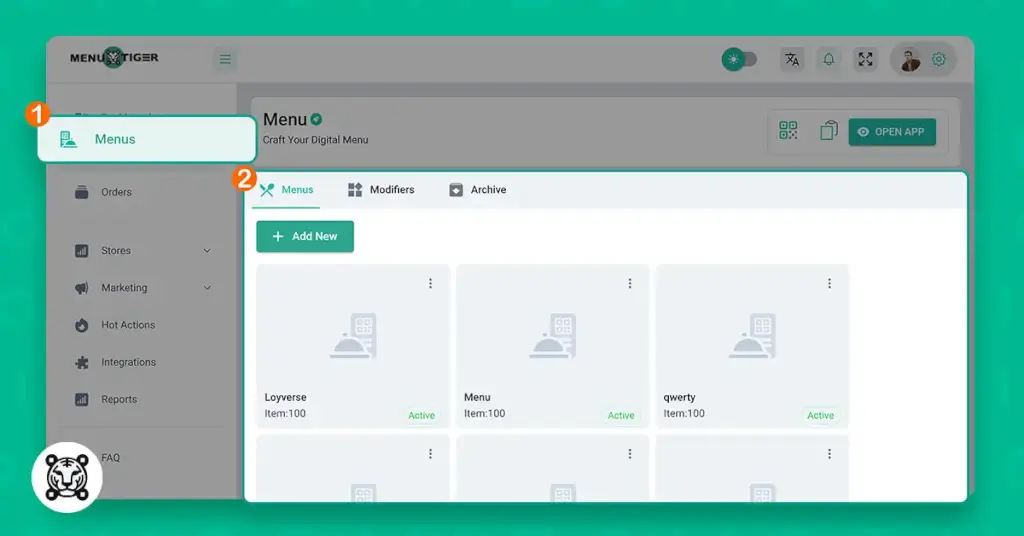

7. Head over to the lefthand side panel and click Menu, then choose the specific menu you want to activate the tax rates in.

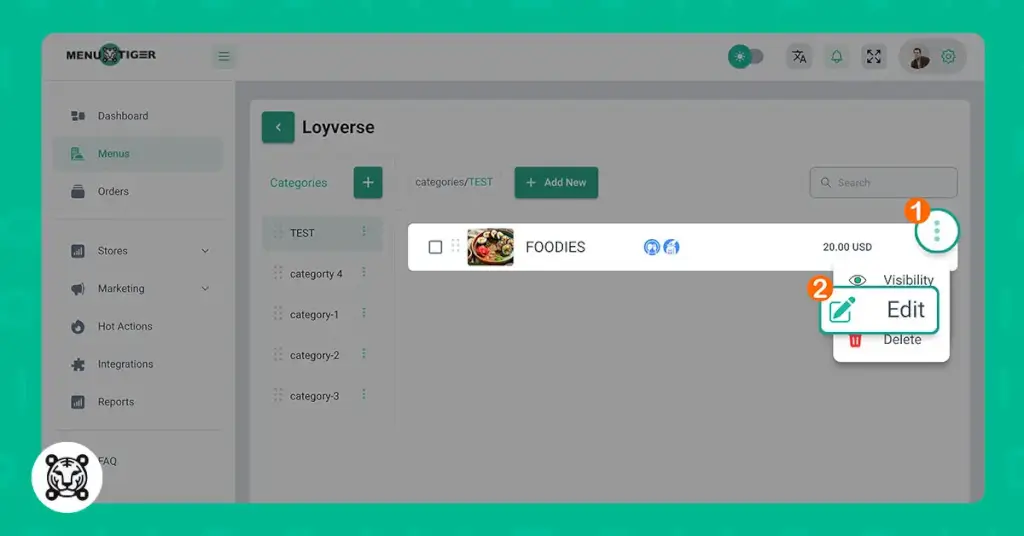

8. Choose the food item you want to add tax with: Click the three vertical dots on the right side, then click Edit.

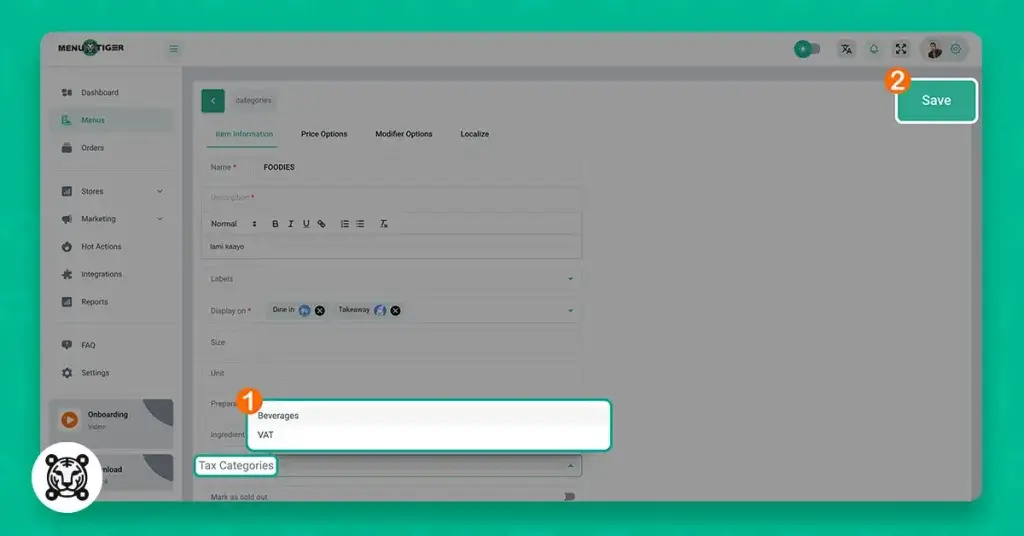

9. Enter the taxation you just created in Tax categories. Once done, click the Save button in the upper right corner.

Importance of pricing menu items

As a restaurant owner, you are constantly making decisions that impact the success of your business.

One of the most critical decisions you make is how to come up with a reasonable and profitable QR code menu price.

Proper pricing can make or break your business, especially if you want to maximize the availability of your payment integrations. Here are five reasons why it’s of utmost importance:

Revenue generation

The pricing of your menu directly affects your revenue generation.

If your prices are too high, customers won’t dine at your restaurant again and will look for a cheaper alternative. Meanwhile, you may not generate enough revenue to cover your expenses if they’re too low.

Finding the right balance is crucial to ensure that you are generating the maximum amount of revenue possible.

Your prices shouldn’t be too expensive to encourage more customers, but not too cheap so you can still have profit.

Profit margins

Your profit margin is directly related to your prices since it is the difference between your revenue and expenses.

You must price your menu items wisely to cover your ingredients, labor, and overhead costs and make a reasonable profit. And with today’s sky-high prices, you must carefully consider this.

Your business won’t be doing you any good if you don’t see any growth.

Perception of value

Your prices also affect how customers perceive the value of your menu items. Customers may think your food doesn’t taste great and are not worth trying if they're priced too low.

But then again, customers may feel like they’re not getting their money’s worth if your prices are too high. You must create a balance between pricing and quality.

To do this, strategize menu pricing in your restaurant without compromising the quality of your food items.

For instance, you can list all the ingredients used in each menu item. Also, include the recipe standard of your menu by specifying the exact measurements and preparation techniques. This will also make you strategize tax preparation assessments to help your business come up with selling prices.

After that, you can calculate the ingredient and overhead costs, operating expenses, and others to create a reasonable selling price with a profit margin.

Competitiveness

In stiff competition with other food establishments, the correct prices can give you an edge. Remember: People are more likely to choose the more affordable option.

If you have the same menu as a competitor, but yours are pricier, there’s a huge chance that diners won’t go to your place and eat at your competitor's instead.

On the other hand, you may attract more customers if your prices are lower, but it can also affect your profit margins.

Therefore, you must thoroughly analyze your competition’s pricing strategy and find the proper balance to stay in the competition.

Menu engineering

Menu engineering in pricing food items involves strategic designing and crafting a menu that maximizes your restaurant’s profitability.

You can change some pricing on your menu based on affordability by examining sales data, food costs, and consumer preferences. Additionally, you can advertise specific dishes and highlight high-profit goods to boost sales.

Additionally, menu engineering allows you to modify your marketing plans in accordance with market trends.

This adaptability helps you respond to shifts in the cost of ingredients, broader economic trends, and clientele expectations, keeping your company profitable and competitive.

Get to know how much tax is added to restaurant foods

Understanding the local tax system of your area can help you make informed budgeting and pricing decisions.

Restaurant food is always subject to the state's Sales and Use Tax and any additional local sales taxes that may apply. Check out these popular states and cities and know how much tax is included in the price of menu items.

California restaurant food tax

One of the dreaded aftermaths of the California minimum wage increase is also a surge in tax rates. It's a good thing the restaurant taxes in California remain at 7.25% to 10.25%, depending on the county.

Chicago restaurant tax

Chicago imposed a general 10.75% restaurant tax in 2020. Additionally, the combined sales tax for restaurants inside the MPEA Food and Beverage Tax zone will be 11.75%, including the 0.50 restaurant tax levied by Chicago and the 1.00% MPEA food and beverage tax.

Massachusetts restaurant tax

Massachusetts levies a 6.25% restaurant tax on all meals served. These fees must be individually mentioned and charged on the invoice after being collected from the buyer.

NYC restaurant tax

The Big Apple has some of the world’s top restaurants, leading the city to levy substantial taxes totaling 8.875%, which consist of:

- A 5% service tax of 5%

- A 4% sales tax, and

- A 0.375% levy from the Metropolitan Commuter Transportation District

Virginia restaurant tax

In 2020, Virginia's average prepared restaurant food tax was 5%, matching Chicago's rate. Some restaurants in other areas may have an additional 6.5% tax. But most establishments add a 2.5% tax on food.

How restaurants can benefit from adding tax rates to menu prices

One of the critical components in competing with other businesses in the restaurant and hotel industry is improving efficiency and customer happiness.

And by including tax rates on menu items, you may enhance both the operational efficiency of your restaurant and the overall satisfaction of your patrons.

The following are the main benefits of including tax rates in menu prices.

Transparent pricing

When you add taxes to your menu prices, your clients will know right off the bat how much their order will cost.

Being transparent prevents uncertainty or unexpected expenses when the bill arrives. It promotes trust and happiness among your target customers as an aftermath.

Improved efficiency

Your staff may take too long to calculate and apply taxes separately to each invoice, which could result in mistakes and delays.

However, you can speed up the billing procedure by directly including tax rates in the menu prices.

This enables your team to concentrate more on providing outstanding services, and cutting down wait times to increase positivity in restaurant surveys.

Enhanced customer experience

Customers enjoy dining better when they know exactly how much they will pay. With taxes already added to your prices, they won’t have any unpleasant surprises upon paying.

This also lets your clients relax while enjoying their meals without worrying about unexpected costs.

Pricing consistency

You should add tax rates to menu prices to provide uniform pricing across all platforms and touchpoints.

Customers can anticipate the same pricing, whether dining in person or purchasing online, creating a sense of accountability and trustworthiness.

Competitive advantage

Standing out among your competitors is crucial to reel in more customers. You can distinguish yourself from rivals by providing transparent services through tax-inclusive menu prices.

Restaurants can gain a competitive edge by applying tax rates to their prices since it ensures consistent pricing, encourages openness, and improves customer satisfaction.

Taxes in menu pricing made easy using a QR code menu

Adding tax rates to menu prices allows you to adhere to legal and tax obligations. This is a good business practice, showing you follow local rules and regulations.

Aside from abiding with the law, this also promotes transparency among your diners. You can also develop solid client relationships, improving your restaurant's dining experience.

Little adjustments can have a tremendous impact on the restaurant and hospitality industry. Including tax rates in menu prices is a straightforward but crucial first step.

And you can effortlessly incorporate these restaurant food taxes into your menu with the aid of MENU TIGER, the best QR code menu software. Sign up for our free trial today.

Claire

Claire, with two years of writing experience and a deep love for the restaurant industry, seamlessly blends creativity and SEO skills, utilizing her MENU TIGER expertise to create content that pleases both readers and search algorithms.